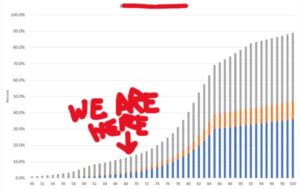

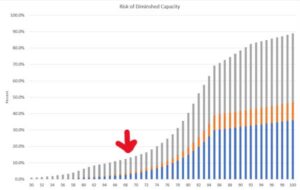

At a recent meeting of top advisors hosted by education innovator Wright State University (where flight was born), I shared this chart under the guise of “opportunity”.

What’s the subject?, I asked. Tesla stock price? Bitcoin projection? Spending on FinTechs? Nearly a perfect S-curve, which favors the early adopters. And the best news, we can catch this one just before the S takes flight – note the arrow.

The big reveal caused a mixed reaction. The majority of the audience reacted thoughtfully, many nodding heads. These advisors see the landscape – every day – through the lives of their clients, their friends and families. The chart is a propensity chart, depicting the likelihood of experiencing some level of incapacity due to one of the three most common health events to cause incapacity – Alzheimer’s, other forms of dementia, myocardial infarction (heart attack).

The savvy advisors know from experience that each of these ailments presents a life change – to the client/patient and to the family. The impact is both immediate and ongoing. Nothing is ever the same. Priorities change. In the world of financial and retirement advice, advisors are needed more than ever and for more complex services.

Our response is critical. We have to react with empathy, engage professionally and with confidence. We become the financial emergency room, transitioning to long-term care. And not just for our primary, affected client – we have to be there for perhaps three generations of family members who are now also affected. Everyone needs to know we have this, we can help.

We don’t have much time before these conditions accelerate in frequency. The current overall propensity rate is 1 in 8 for people age 68 but more than doubles by 78 – and 6X at 88. Over the next ten years, nearly 1 in 3 people we now serve are likely to become incapacitated themselves, and a great many more will be impacted by someone in their life who becomes incapacitated.

For advisors and their firms serving the Baby Boomer age wave of 76 million people, this transition has been looming…but preparation is still light. Every firm and every advisor will need policies, procedures and supportive tools to:

- Identify incapacity for the protection of the client, her family and the firm

- Protect clients and their families from the threats of incapacity, including identity theft, fraud and elder abuse

- Engage families in support of incapacitated clients – as well as clients without family support

- Adjust to the needs of a family of three generations or more and help optimize finances for risk, tax, income and long-term care

Don’t Ignore This Moment

If you are winding down your advisory career, you might be doing the math and saying that in ten years you will be on a beach living the vida mas fina. That’s probably pretty well known by your clients and their families. As Accredited Investor co-founder, Ross Levin said so well at our Next Chapter Rockin’ Retirement event on May 24, top firms are winning clients and keeping clients because they have a “contract” with clients and their families that the firm will be there for them. Another speaker, veteran Tom Bradley of Schwab noted that aging clients – and aging advisors – are now important measures for the valuation of an advisory practice (get the whole program here ADD LINK to NEXT CHAPTER MEMBERSHIP).

One very interesting aspect of this chart is that it is also a good picture of the demand for pretty much everything associated with the historic demographic cohort. If they will need it, you name it and the growth curve will be similar. Demand for in-home caregivers, Medicare counselling, pickleball courts, assisted living facilities…they’re all here at the same time. Consider…..

The Price of Ignorance – Five Risks Ahead

I’ve also spent a lot of time worrying about this issue on behalf of big company clients and I see five significant risks of keeping our heads in the sand:

- We lose current clients and their assets

- We lose the potential consolidation of assets held by our clients elsewhere – that’s a pretty similar number to the total in 1 above

- We lose the client’s family – if we don’t take care of the primary client, the family won’t stick around. Surviving spouses and adult children have no affinity for our failure to act.

- We risk increasing scrutiny as fiduciaries or service providers that do not sufficiently “know your client” – an area of growing interest to state consumer protection regulators. Get ready also for a return of active arbitration in this area as we return to in-person activity after a pandemic slowdown.

- Finally, a firm that does not do well by its aging clients is exposed to significant reputational risk. Poor experiences might be contained in the complaint process, but some of the more colorful cases will doubtless make headlines – electronic or otherwise. I expect a lot of interest in these stories.

Other Than That Mrs. Lincoln, How Was the Play?

Every corner of the financial advice and investment management industry has benefited handsomely, unexpectedly from the historic demographic wave and the power of that wave to lift all economic boats. Now it’s time to repay some of that value by meeting the needs of our loyal clients and their families – all of whom will be encountering their longevity for the first time. Our ability to serve is a function of both will and skill. I’m completely confident we have the skill. Do we have the will?

Steve Gresham is on a mission to improve longevity and “retirement”. He leads an industry initiative, Next Chapter, and is ceo of consulting firm, The Execution Project, LLC. He is also senior educational advisor to the Alliance for Lifetime Income. Formerly head of Fidelity’s Private Client Group, he is the author of five books about wealth management including The New Advisor for Life. He also served for eight years on the faculty of Brown University where he taught the impact of an aging population.